VMAC, manufacturer of vehicle-mounted air compressors, is back with another State of the Mobile Compressed Air Industry survey. This year, VMAC surveyed 355 individuals between November 2020 and February 2021. These individuals came from a variety of industries such as construction, municipal, oil and gas, forestry, transportation, utilities infrastructure, mining, and agriculture. Although participants represented various industries and job titles, they each have one thing in common: They use mobile air compressors.

The goal of VMAC’s first State of the Industry survey from last year was to allow mobile air compressor users to compare their operations and usage to other businesses also using mobile air compressors. VMAC discovered the results of the 2020 survey were viewed, shared, and downloaded by hundreds of individuals, solidifying a need for this information in the compressed air industry. For the 2021 survey, VMAC added four questions related to the COVID-19 pandemic’s impact on the industry. How does your business relate to the results from this year’s survey?

INDUSTRIES SERVED

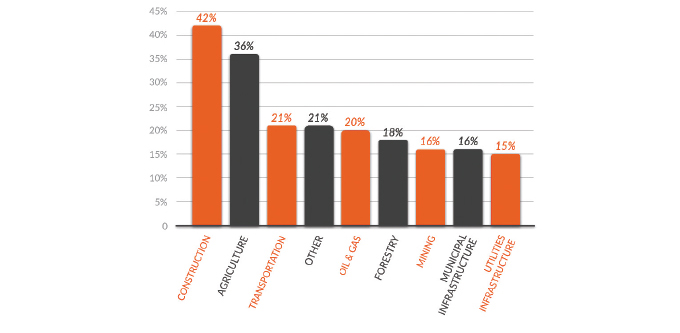

What industry do you serve?

This year’s industry representation looked a bit different. Construction (42%) and agriculture (36%) dominated the industries identified, whereas last year the top industries were construction and heavy equipment. Transportation and “other” took the third place spot at 21% with all other industries following behind.

SIZE OF FLEET

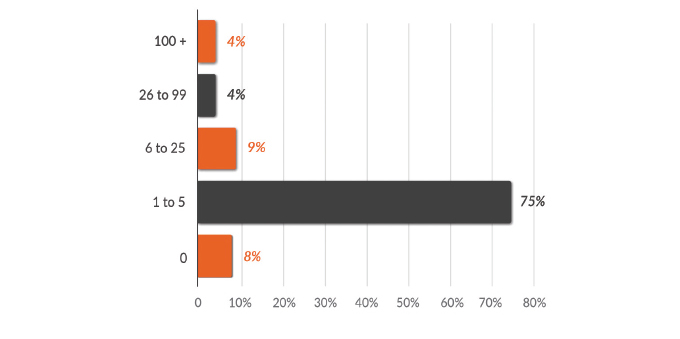

How many service trucks are in your company’s fleet?

Keeping in line with 2020’s survey results, the vast majority of respondents (75%) are part of small fleets of one to five trucks. The largest group below small fleets were fleets of six to 25 trucks at 9%. Large fleets of 100 vehicles or more made up only 4% of survey respondents compared to last year’s 7%.

VEHICLE CLASS

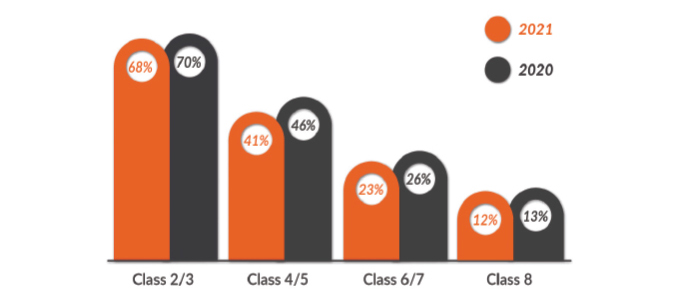

Which classes of service trucks do you have in your fleet?

Light-duty vehicles remained the top class of trucks, dipping only two percentage points between 2020 (70%) and 2021 (68%). Class 4 and 5 made up the next highest majority with 41% of respondents indicating they own a medium-duty vehicle.

AGE OF FLEET

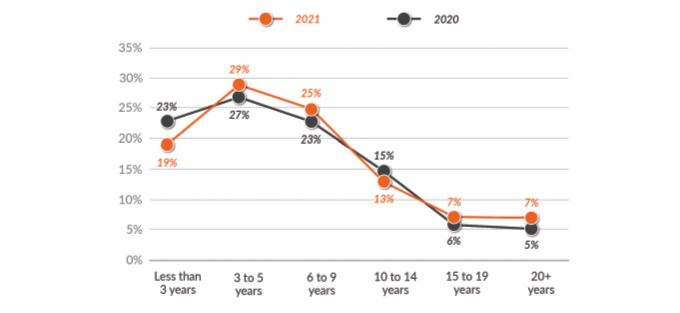

What is the average age of service vehicles in your fleet?

Newer vehicles weren’t only a popular choice for fleets in 2020, they are also a popular option for fleets this year as well. VMAC’s survey found that 73% of fleets are made up of fleet vehicles that are 0 to 9 years old. However, up two points from 2020, 7% of respondents reported an average age of 20 years for fleet vehicles.

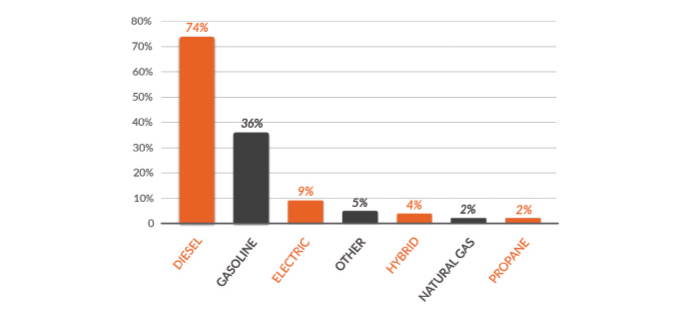

FUEL TYPE OF FUTURE VEHICLES

What kind of service vehicles are you interested in buying?

Those with vehicle purchases in their plans were asked to indicate the fuel type of the vehicles they planned to buy. Diesel was the clear choice with 74% selecting the fuel type. Gasoline was second with 36%. According to the data, alternative-fuel vehicles are not a popular choice among these owners and operators.

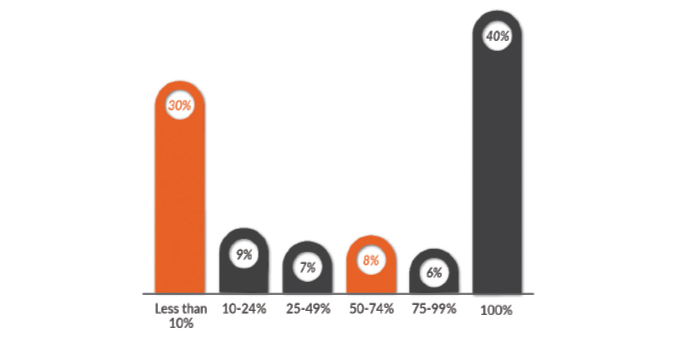

AIR COMPRESSORS IN THE FLEET

Approximately what percent of your service vehicles are equipped with air compressors?

Just as in 2020, a divide exists between vehicles equipped with air compressors and vehicles that aren’t equipped with air compressors. While 30% of respondents indicated less than 10% of their vehicles are equipped with an air compressor (which is the same amount as 2020), 40% indicated that 100% of their vehicles are equipped with them. This is up from 28% in 2020.

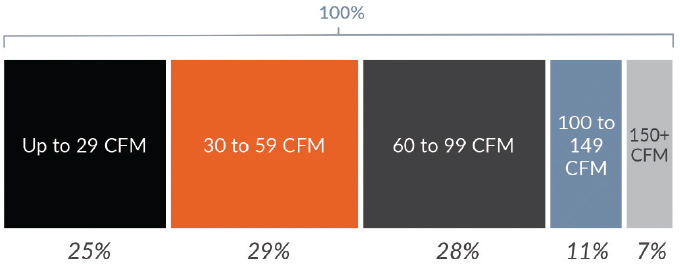

CFM/PSI REQUIREMENTS

What cfm range best fits your requirements for your service vehicles?

Over half of VMAC’s survey respondents require up to 59 CFM on service vehicles (54%). This is consistent with 2020’s results. Those who require 60 to 149 CFM make up 39% of respondents. Only 7% require 150-plus CFM.

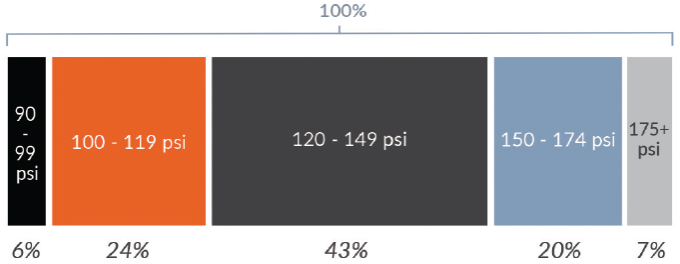

What PSI range best fits your requirements for your service vehicles?

Most respondents indicated a need of 100 psi or more (94%). This number is also consistent with last year’s numbers.

WHY ROTARY SCREW?

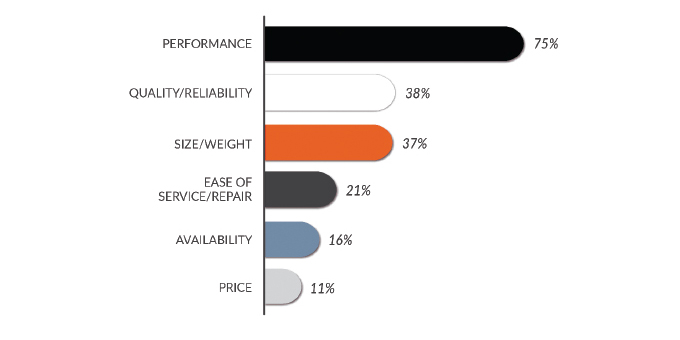

Why do you prefer rotary screw air compressors for service vehicles?

When asked why they prefer a rotary screw air compressor, the majority (75%) noted it was because of their performance, 38% noted quality and reliability, and 37% said size and weight.

WHY RECIPROCATING?

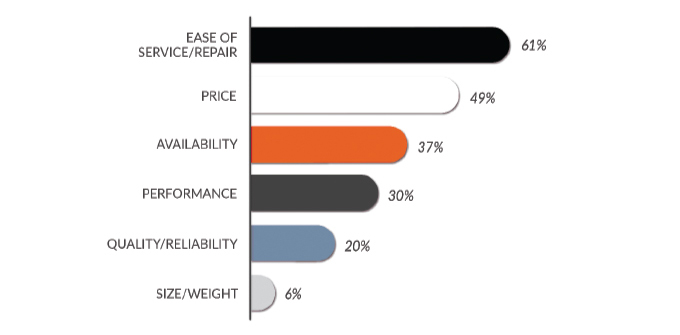

Whey do you prefer reciprocating air compressors for service vehicles?

Consistent with 2020’s results, when asked why they prefer reciprocating air compressors, almost half of respondents indicated it was because of their ease of repair/service (61%). Another common reason was the price (49%).

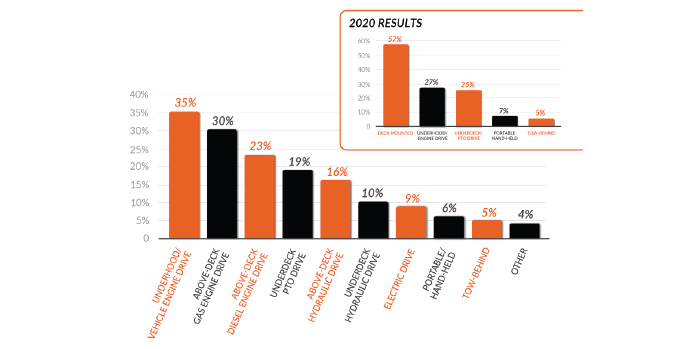

AIR COMPRESSOR SYSTEMS

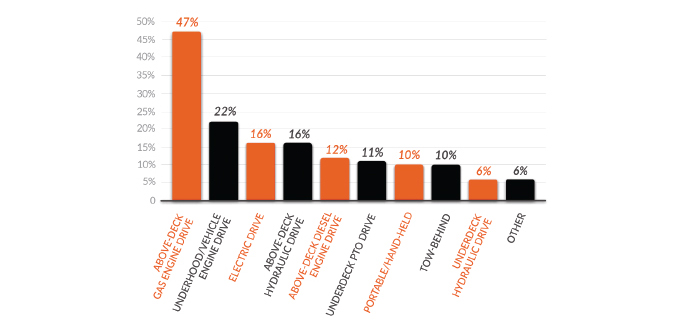

What type of air compressor system do you use on service vehicles?

Nearly half of all respondents (47%) use above-deck gas engine drive air compressors. Next up is an UNDERHOOD or vehicle-engine driven air compressor at 22%. Other types of air compressors are used in 16% or fewer of respondents’ fleets.

INVESTMENTS

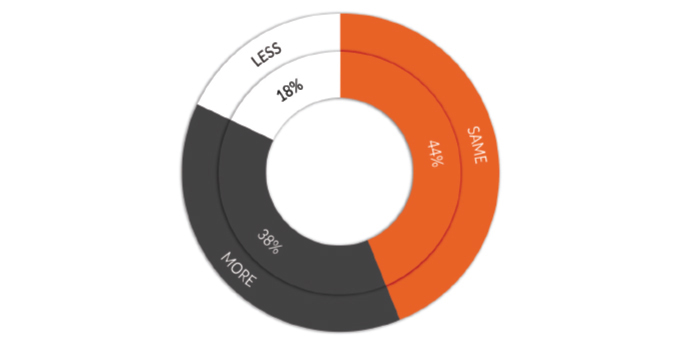

Compared to 2020, how much do you plan to invest in new vehicles/equipment in 2021?

When comparing between 2020 and 2021, respondents were asked to indicate their plans to invest in new vehicles and equipment. The majority (44%) said their plans to invest remain the same for 2021 as they were in 2020, while 38% plan to buy more this year than last.

STYLE PREFERENCE

What style of air compressor do you prefer on service vehicles?

Respondents were asked which style of air compressor they currently use and which they prefer, checking all that apply. More than one-third of VMAC’s survey respondents indicated a preference of UNDERHOOD or vehicle-engine driven air compressors. Next in line were above-deck gas driven air compressors (30%).

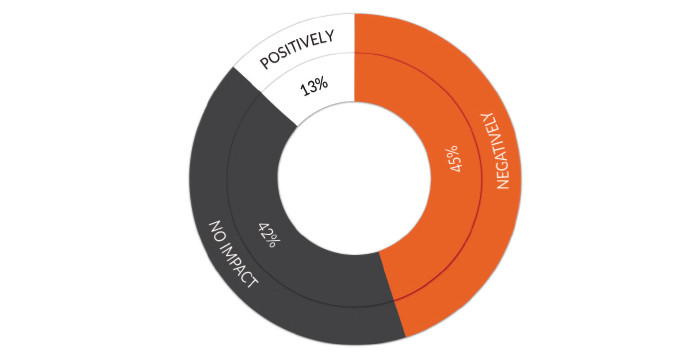

COVID’S IMPACT

How has covid-19 impacted your business?

VMAC added COVID-19-related questions to the 2021 survey. According to respondents, 45% have experienced a negative impact from the pandemic. However, 13% say they have seen a positive impact, and 42% have seen no impact at all.

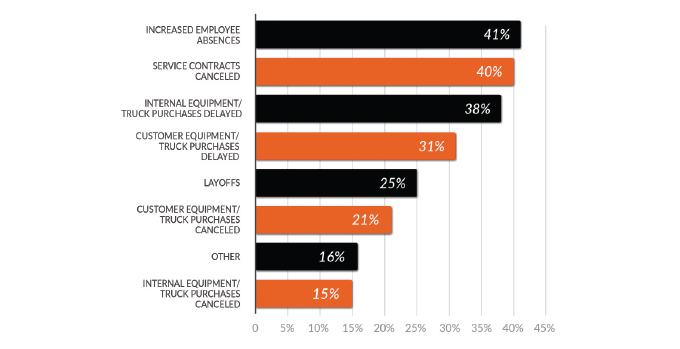

SPECIFIC IMPACTS

How has covid-19 impacted your business?

When asked which areas of business have seen the most impact of the pandemic, respondents noted an increase in employee absences (41%) with canceled service contracts following directly behind (40%). Respondents also noted other areas of business with COVID-19 impacts including equipment and truck purchase delays, layoffs, and canceled purchases.

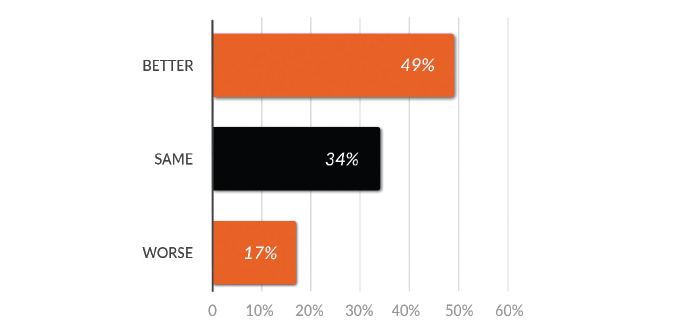

12-MONTH OUTLOOK

What do you think business conditions will be like in the next 12 months?

Will business improve over the course of the next 12 months? Will the pandemic continue to wreak havoc? Many respondents of VMAC’s survey feel conditions will be better (49%), while others feel it will remain the same (34%). Unfortunately, 17% of respondents believe business conditions will worsen within the next 12 months.

FOR MORE INFORMATION

The data from this piece was provided by VMAC.

Download the complete survey, visit www.vmacair.com/survey.