RETHINKING A FAMILIAR FLEET TOOL

Fuel cards have been a part of fleet operations since the early 1980s, but despite decades of evolution, many fleet managers still view them primarily as payment tools. That perception no longer reflects today’s reality.

According to the 2025 State of Fleet Cards Report from Shell Fleet Solutions, 95 percent of fleet managers agree that fuel cards provide valuable operational insights. Yet surprisingly, 38 percent of fleets surveyed don’t use one. This usage gap underscores how legacy views are preventing some fleets from capitalizing on modern innovations.

Today’s fleet cards go far beyond the pump. They integrate digital tools, enable detailed data tracking, provide advanced fraud protection, and support EV charging. They are quickly becoming central to strategic fleet management, not just tactical payment processing.

In a world where fleet leaders are expected to do more with less, modern fleet cards offer actionable insights that can drive both savings and operational transformation.

FUEL CARDS AND THE MODERN COST EQUATION

Fuel remains one of the largest controllable expenses in fleet operations. Managing that cost has become even more critical amid ongoing economic uncertainty.

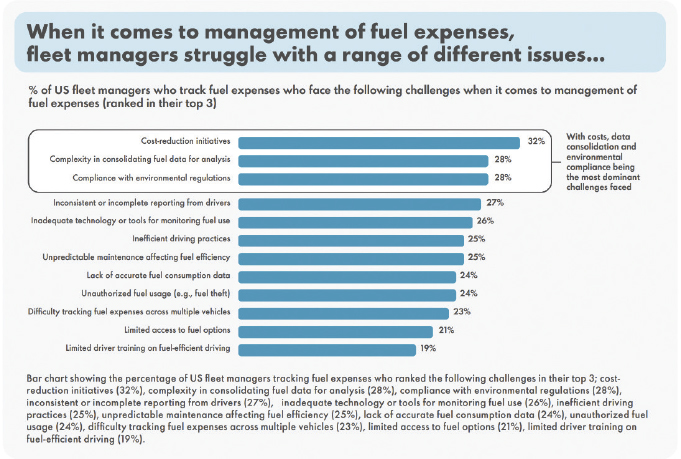

According to Shell Fleet Solutions’ report, 32 percent of fleet managers listed cost reduction as their top challenge, while 28 percent cited difficulty consolidating fuel data. Manual methods of expense tracking can make tracking and optimizing fuel spend almost impossible. Yet 25 percent of US fleets are still entering data in spreadsheets and another 25 percent are logging transactions by hand on paper records.

Modern fleet cards resolve these issues. For example, the Shell Card includes an online portal, which streamlines workflows and operations by eliminating the need for manual expense tracking entirely, and analytics that turn complex data into actionable insights.

These tools, included with cards, enable fleet operators to set custom controls, monitor transactions in real time, and act on trends before they affect the bottom line.

WHY SOME FLEETS STILL HESITATE

Despite these advancements, many fleets remain hesitant to adopt or expand fuel card usage. Among non-users surveyed, 86 percent cited a lack of advanced security features, and 75 percent expressed concerns about digital fraud risks.

However, these concerns often stem from past experiences with outdated technology. Today’s leading fuel card platforms have invested heavily in security.

Mobile Innovations: Contactless mobile payments, biometric authentication, and automatic receipt capture, reducing card loss, input errors at point of sale, and burden of paper receipts.

Safer Payments: Chip-enabled cards and advanced encryption protocols like Advanced Encryption Standard (AES) and Transport Layer Security (TLS) ensure secure transactions.

Purchase Controls: Fleet managers can limit purchases by driver, vehicle, time of day, fuel type, location, amount.

Better Visibility: Automatically capture Level III data providing granular transaction details like driver ID, odometer reading, fuel type, and price per gallon.

These features are now considered standard for enterprise-grade fuel programs. Even smaller fleets can access advanced fraud prevention previously limited to large operations. Security doesn’t have to be a barrier. It can—and should—be a key benefit.

SOLUTIONS FOR MORE THAN FUEL SPEND

Managing fuel is just one part of the challenge. Fleets also face issues with driver behavior, data overload, and unauthorized use. Shell’s report found that 28 percent of fleets struggle to consolidate fuel data, 26 percent lack adequate monitoring tools, and 24 percent report unauthorized purchases or theft.

Fleet cards now provide solutions previously available only through telematics platforms, such as: custom spend limits by driver or vehicle, alerts for off-hours fueling or unusual purchases, and automated exception reports to flag anomalies.

Tools like ClearView transform raw transaction data into digestible dashboards, allowing managers to visualize efficiency trends and take targeted action. When paired with route optimization, EV integration, and maintenance scheduling, fuel cards become central to managing total cost of ownership.

SUPPORTS PAYMENTS FOR ALL FLEET TYPES

Some fleets are managing both internal combustion engines (ICE) with electric vehicles (EVs), as Shell’s report shows that 37 percent of fleets have already adopted EVs.

Modern fuel cards are evolving to support this hybrid reality. The Shell Card allows:

Payment for public EV charging across major networks including Shell Recharge, ChargePoint, Blink, and EVgo.

At-home EV charging reimbursements for company drivers, with automated payout processing through Shell Account Manager Online.

Consolidated invoicing for both fuel and electricity, simplifying accounting and reporting across fleet types.

This unified platform is particularly valuable for fleets transitioning gradually to EVs, enabling consistent payment, data, and security experience across vehicle types. This all-in-one functionality makes it easier for fleets to adopt EVs without increasing administrative complexity.

WHERE FLEETS ARE GETTING THE MOST VALUE

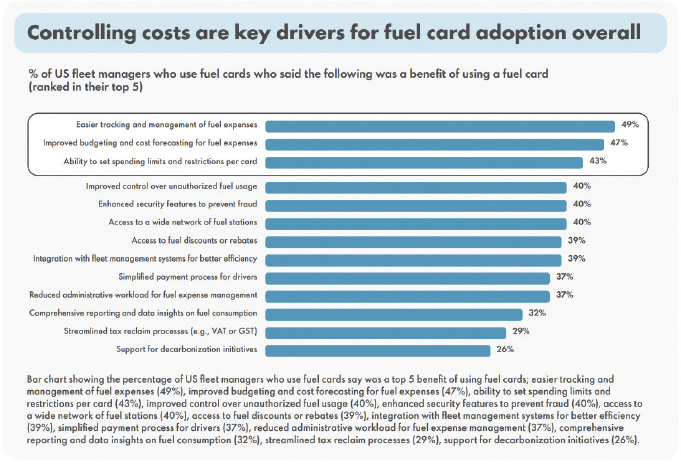

For the 62 percent of fleets already using a fuel card, the results are tangible. Nearly half (49 percent) cite easier expense tracking and management as a top benefit. Others point to improved budgeting (47 percent) and the ability to set card-level spending controls (43 percent).

Additional value drivers include reduced admin time (no more paper receipts or manual reports), real-time alerts for unauthorized purchases, visibility into vehicle and driver-level performance, and discounts on fuel and preventive maintenance.

Fleet managers also benefit from more accurate forecasting. With comprehensive historical data available at their fingertips, they can better predict future expenditure and optimize fuel procurement strategies accordingly. By replacing reactive management with proactive tools, fuel cards help drive smarter decisions—and better financial outcomes.

TIME FOR A SECOND LOOK

The data is clear: fuel cards are no longer just plastic payment methods, they are essential management tools for the modern fleet. Shell’s 2025 State of Fleet Cards Report shows that most fleets recognize this evolution. However, for the 38 percent not yet leveraging a card program, there may be missed opportunities. Not only in direct savings from discounts and rebates, but through optimized operations.

With integrated EV support, customizable controls, and deep analytics, cards deliver meaningful results. As operational costs continue to rise and digital transformation becomes a necessity, now is the time for fleets to give fuel cards a second look. Since when used to their full potential, fuel cards can be a simple path to a better bottom line.