With tariffs and supply chain pressures reshaping the automotive landscape, fleet managers must rethink how they spec, source, and implement work van upfits to stay efficient and cost-effective.

In today’s fleet environment, van upfits are more than just a finishing touch—they’re strategic investments and a foundational element of operational success. Whether it’s organizing tools, boosting technician safety, or improving ergonomics, upfits are essential to keeping mobile workforces productive and professional.

However, with the various pressures and evolving worksite demands, fleet managers must be more deliberate than ever in their approach to upfitting.

MWS spoke with industry specialist Alexa Rubin from Mike Albert Fleet Solutions for answers.

MWS: WHY ARE VAN UPFITS IMPORTANT?

ALEXA RUBIN: For many vocational fleets, a vehicle without an upfit simply isn’t functional. Upfits provide the structure and organization that technicians need to do their jobs efficiently. They reduce time spent searching for tools, make it easier to inventory, track and maintain parts, and reduce the likelihood that expensive equipment will be damaged. This, in turn, cuts down on technician downtime and fleet expenses.

However, the benefits go deeper. When tools and parts are stored in the “power zone” between the shoulders and hips, technicians experience fewer repetitive motion injuries and less physical strain. This ergonomic advantage translates into fewer workers’ compensation claims and more uptime on the job.

Upfits also play a role in both employee and customer satisfaction and retention. Many technicians bring their own tools to work, and having a clean, well-organized space to store them not only protects their investment but also fosters pride in their vehicle. A tidy work van presents well to customers and inspires repeat business.

MWS: WHAT ARE SOME BEST PRACTICES YOU RECOMMEND FOR COST-EFFECTIVE VAN UPFITTING?

RUBIN: To get the most value from an upfit, fleets should take a strategic approach. A successful upfit strategy begins with a deep understanding of how each vehicle will be used. This means engaging stakeholders across your organization—from technicians to operations managers—to ensure the upfit aligns with real-world needs.

STRATEGY 1: START WITH THE JOB, NOT THE VEHICLE

Before selecting equipment, layout, or even the make and model, start with the technician’s daily tasks—then build the upfit around those needs. Are technicians working in HVAC, telecom, or mobile repair? Each trade has unique storage, power, and access needs. When you start by defining the core tasks the van must support, you’ll ensure the layout supports productivity and safety.

STRATEGY 2: STANDARDIZE WHERE POSSIBLE

It seems like talking out of both sides of your mouth; however, while customization is important, too many unique specs can complicate vehicle procurement and maintenance. Standardizing upfit packages across similar roles can reduce costs, simplify maintenance, and improve fleet flexibility.

STRATEGY 3: EVALUATE LIFECYCLE, NOT JUST ACQUISITION

A cheaper upfit may cost more in the long run if it leads to inefficiencies or frequent repairs. An upfit that saves time in the field or reduces injury risk can pay dividends over the vehicle’s life. Consider ergonomics, ease of access, and modularity when designing your layout. Use total cost of ownership (TCO) modeling to compare options and justify higher upfront investments when they offer long-term savings.

STRATEGY 4: LEVERAGE VOLUME PURCHASING.

Fleet management companies (FMCs) offer more than just procurement support. They can often negotiate better rates through bulk purchasing agreements. By aligning your upfit specs across multiple vehicles, you can benefit from economies of scale. Plus, FMCs bring deep relationships with OEMs and upfitters that can offer early insights into spec changes or supply chain disruptions. These advantages help clients plan and avoid costly surprises.

MWS: HOW CAN FLEETS MANAGE UPFIT COSTS IN LIGHT OF TARIFFS AND INFLATION?

RUBiN: Recent tariffs on imported steel, aluminum, and vehicle components have raised concerns about rising costs. While domestic components may carry a higher initial sticker price, the fact is, any upfitter that manufactures and assembles in the U.S. will be largely protected from tariffs.

Mike Albert Fleet Solutions has experienced firsthand how pricing and availability can be maintained by sourcing from within the American supply chain. Adrian Steel in Michigan and Decked in Ohio are two examples of our partners who have invested in their communities and thus are more insulated from tariff concerns. Some upfitters now prioritize U.S.-made shelving, partitions, and lighting systems to avoid tariff-related surcharges and take advantage of shorter lead times. Even some vendors with Canadian roots have shifted operations stateside to avoid tariff exposure.

While some components—like wiring harnesses or injection-molded plastics—may still be subject to tariffs, they typically represent a small fraction of the total upfit cost. The overall impact on pricing has been minimal, especially when fleets work with vendors who prioritize domestic sourcing.

MWS: WHAT TRENDS ARE SHAPING THE FUTURE OF VAN UPFITS?

RUBIN: The upfit industry is evolving rapidly in response to market pressures and new technologies. Here are a few trends to watch:

- Unconventional vehicles – When OEMs began scaling back production of compact vans—starting in 2018 with Chevrolet’s decision to discontinue the City Express—the upfit industry had to get creative to meet customer demands. From pickups to SUVs to crossovers, fleets are turning to unconventional vehicles and adapting them with creative upfit solutions. This flexibility has made the industry more resilient, innovative, and resistant to disruption.

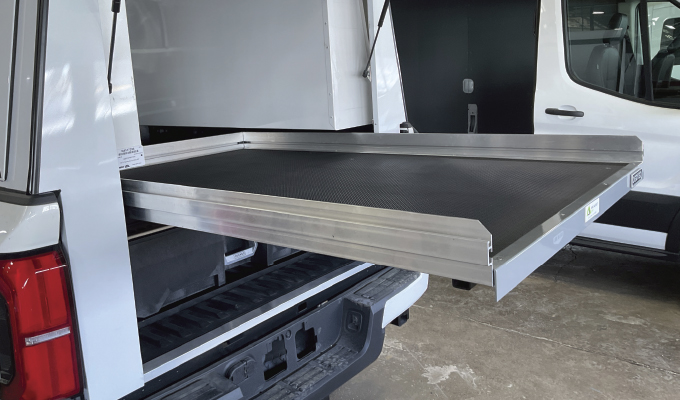

- Deck slides – Deck slides and modular storage are gaining popularity for their ergonomic benefits and space efficiency. They allow technicians to access tools without having to climb into the vehicle, bend over, or shove heavy parts into the van. Easier access to jobsite essentials reduces strain and improves workflow.

- Trade-specific packages – Pre-configured trade packages are gaining popularity for their speed and simplicity. These kits—tailored for electricians, plumbers, or delivery drivers—reduce design time and ensure consistency.

- Electrification – As electric vans enter the mainstream, upfitters are rethinking materials and layouts to preserve battery range. Lightweight aluminum shelving and low-draw electronics are becoming standard in EV upfits.

- Safety and visibility enhancements – LED lighting, backup cameras, and ergonomic access points are now baseline expectations. Some fleets integrate telematics to monitor how upfits affect driver behavior and vehicle performance.

Van upfits remain a critical investment—but they are no longer a one-size-fits-all proposition. They require thoughtful planning and keeping a keen eye on both current costs and future value. The key to a successful upfit strategy is to stay proactive. With the right partners and a thoughtful approach in place, it’s possible! By following best practices, leveraging strategic partnerships, and staying attuned to industry trends, fleet managers can ensure their vans are not just road-ready, but future-ready.

about the interviewee

Alexa Rubin is a fleet strategy consultant at Mike Albert Fleet Solutions, where she helps clients optimize their fleet design, vehicle acquisition, and upfit strategies. She draws on deep-industry relationships, a passion for practical, people-first solutions, and her background in logistics and operations, to drive efficiency and ROI.