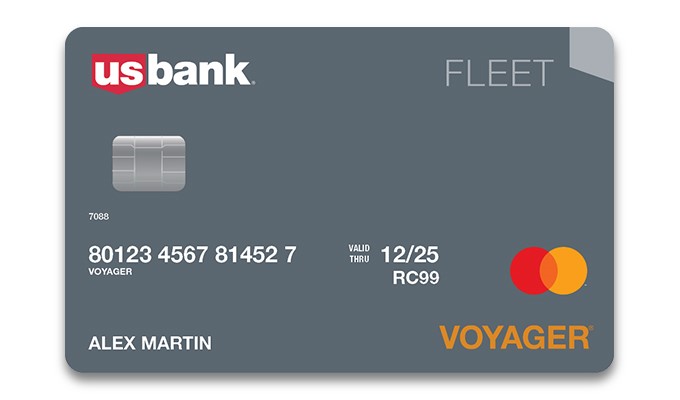

US Bank announced a partnership with Mastercard to offer the US Bank Voyager® Mastercard®. The US Bank Voyager Mastercard can be used for fleet-related expenses anywhere Voyager or Mastercard are accepted.

US Bank currently offers the Voyager Fleet Card for fleet operators to pay for fuel, maintenance, and other expenses. Operators can use these cards at more than 320,000 locations across the US using the proprietary Voyager Network.

The US Bank Voyager Mastercard enables clients to pay for fleet-related expenses at Voyager merchant locations and merchants accepting Mastercard. Now drivers can use one card to pay for a variety of fleet-related purchases in addition to fuel and maintenance. This includes but not limited to:

- Fees for toll roads or parking

- Fuel in Puerto Rico and other US territories, Canada, Mexico, and other international locations

- Emergency tows or repairs

- Infrequent, emergency, or on-demand travel purchases (e.g., hotel, food)

FEATURES & SERVICES

The Voyager Mastercard allows fleets to tailor spend controls for drivers and vehicles while retaining visibility across the purchase categories. From standard purchases to unexpected situations, fleets have increased flexibility to manage all fleet-related expenses with ease.

The US Bank Voyager Mastercard also provides Mastercard services. These include MasterRental Insurance, Purchase Assurance, Extended Warranty, and travel assistance through MasterAssist Services. As a result, these services give managers and drivers benefits and peace of mind that Voyager Mastercard covers them on the road and beyond.

“The new US Bank Voyager Mastercard is a game-changer for fleet managers and drivers,” says Jeff Pape, senior vice president and director of product and marketing for transportation at US Bank. “Having the capability to cover and control unexpected and planned purchases on two major networks delivers unprecedented flexibility to support fleet operations and productivity.”

“We are thrilled to partner with US Bank to provide fleet managers and drivers a single card product that leverages our network to support day-to-day needs on and off the road,” says Erika Gamboa, vice president, account management at Mastercard. “Together, we are able to provide an enhanced payment experience for fleet drivers with enhanced safety, security, and travel benefits.”