Fleet Advantage announced results of its latest industry benchmarking survey. In the survey, the company took the pulse of industry leaders on topics ranging from the use of alternate-fuel trucks; equipment finance trends; and strategies for environment, social and governance (ESG).

Fleet Advantage executives will discuss the results and provide various complimentary fleet analyses and audits at the upcoming American Trucking Association’s Technology & Maintenance Council Annual Meeting & Transportation Technology, February 27-March 2, in Orlando, Florida.

MORE INTEREST IN BEVS

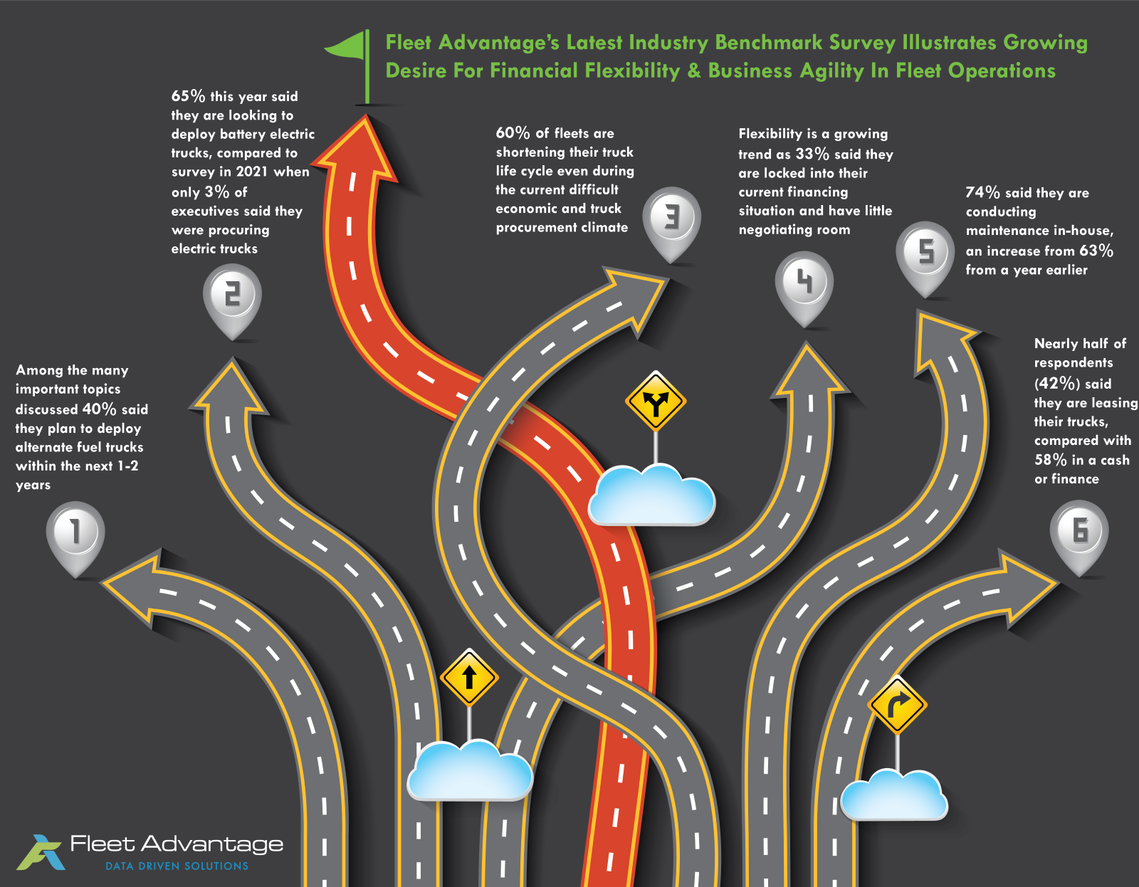

Among important topics discussed, 40% of respondents said they plan to deploy alternate fuel trucks within the next 1-2 years. This is a stark comparison to last year when 54% said they plan to deploy alternate-fuel trucks within 5-10 years. Sixty-five percent of respondents this year said they are looking to deploy battery electric trucks, compared to the previous benchmark survey in 2021 when only 3% of executives said they were procuring electric trucks. Fleet Advantage recently announced plans to place orders for 200 EV Class 8 tractors for deliveries commencing in calendar year 2023. The company is committed to assisting its customers’ transition to alternative energies toward a zero-emissions goal using off balance sheet lease financing with little or no residual risk.

NEARLY HALF OF RESPONDENTS ARE NOW LEASING THEIR TRUCKS

The survey also addressed trends in equipment financing. Forty-two percent of respondents said they lease their trucks compared with 58% in a cash or finance situation. This is a significant jump in leasing compared with last year, when 31% said they were in a lease structure. However, flexibility is a growing trend; 33% said they are locked into their current financing situation and have little negotiating room. This underscores the importance of data analytics such as a lease versus purchase or unbundled versus full-service lease comparisons in the planning and procurement of truck acquisition, where unbundled lease structures offer companies the highest level of flexibility, especially when market conditions, fuel, and interest rates experience volatility.

Organizations should monitor additional key financial metrics to analyze their Total Cost of Ownership, including:

- Sales Tax analysis

- Comparative Cost Analysis to determine the optimal time to upgrade equipment, etc.

- Per unit P&L

- OEM Equipment Cost Tracking

- SWAP Rates

- Residual Values

- Predictive Life Cycle Modeling

Maintenance and repair (M&R) trends continue to be top-of-mind for fleet executives in this year’s survey. Seventy-four percent of respondents said they are conducting maintenance in house, an increase from 63% from a year earlier.

Fleet Advantage fleet services experts will discuss the latest transportation trends and provide complimentary fleet DC audits at the American Trucking Association’s Technology & Maintenance Council Annual Meeting & Transportation Technology, February 27-March 2, in Orlando, Florida.

GREATER FOCUS ON ESG RESULTS IN SHORTER TRUCK LIFE CYCLES

The majority of respondents (59%) also indicated they operate their trucks five years or less before replacement. This coincides with today’s greater corporate focus on ESG. This number is up from 45% in the previous benchmarking survey. This trend is a testament to today’s corporate focus on protecting the environment. Roughly 60% of fleets have shortened their truck life cycle even during the current difficult economic and truck procurement climate.

“The current economic climate continues to present many challenges for fleets all over the country, which is why flexibility is a necessary business and financial strategy to meet corporate and ESG goals in the years ahead,” says Hadley Benton, executive vice president of business development for Fleet Advantage. “Our latest benchmarking study illustrates not only the staunch need for this flexibility, but it also reiterates how companies are changing their philosophies and now have a growing desire to work with asset management partners who offer the right programs that benefit all aspects of their organization to meet short- and long-term goals.”

Find out more, visit www.fleetadvantage.com.